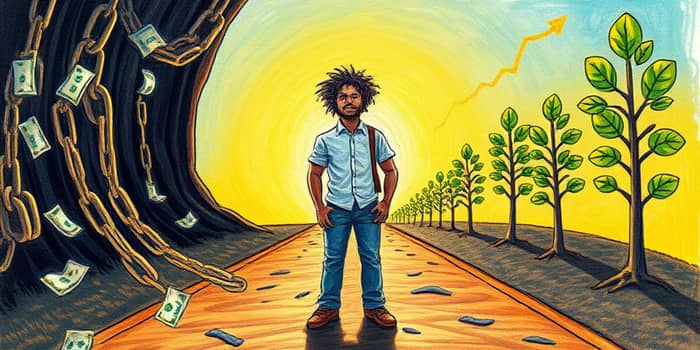

Embarking on the journey from overwhelming debt to lasting wealth requires dedication, strategy, and a shift in mindset. This roadmap will guide you through each critical phase—offering both inspiration and practical steps.

Debt isn’t inherently negative. It can be a tool for growth when managed wisely. It’s crucial to distinguish between generates income or appreciates in value and high-interest credit card balances that drain resources. Mortgages and business loans often qualify as good debt, while unsecured loans at double-digit rates fall into the bad category.

By reframing debt as a resource rather than a burden, you can leverage it strategically—always with clear limits and repayment plans in place.

Your financial recovery begins with self-reflection. Identify personal debt patterns and triggers by tracking every expense and reviewing monthly statements. Recognize emotional spending and recurring traps that push you further into the red.

Shift your perspective: treat every expenditure as a step toward freedom. This psychological shift empowers you to postpone immediate gratification in favor of long-term security.

Blueprint your path forward with a solid budget. The popular 50-30-20 rule divides spending categories—allocating half of your income to necessities, thirty percent to wants, and twenty percent to savings or debt repayment. Customize these ratios to your circumstances, ensuring realistic, measurable goals for debt elimination and wealth accumulation.

Use digital tools or simple spreadsheets to monitor progress and adjust in real time.

Select a repayment method that aligns with your personality and finances. Two proven approaches are:

Each path has merits: the snowball fuels momentum with early wins, while the avalanche saves you interest over time.

Don’t underestimate the power of conversation. Negotiate reduced interest rates with creditors—especially if you’ve maintained a solid payment history. Even a small rate cut can shave hundreds off your total cost.

For complex cases, seek professional credit counseling support. Certified counselors can propose personalized plans and leverage industry relationships to improve your terms.

One lesson from every financial crisis is clear: prepare for the unplanned. Aim to save three to six months expenses in a liquid account. This fund acts as a shock absorber, preventing you from sliding back into debt when unexpected costs arise.

Automate transfers on payday so your emergency reserve grows consistently without relying on willpower alone.

Once high-interest debts are tamed, redirect that cash flow into assets. Invest savings into income-generating assets like diversified stock portfolios, bonds, or real estate. Reinvest dividends or rental income to amplify compounding returns.

Always diversify investments to manage your risk—spreading capital across sectors and geographies to guard against market swings.

For those ready to elevate their strategy, consider debt recycling—using home equity to acquire investment loans. Convert mortgage debt into investment loans that offer tax-deductible interest while building a portfolio of rental properties or stocks.

Alternatively, use rental properties for leveraged growth, where tenant rent covers mortgage costs, and property appreciation delivers equity gains.

Leverage analytics to track performance. Monitor liquidation rates and payoff trends across your accounts to see which strategies yield the fastest results. Segment debts by interest rate, balance size, and creditor to enable targeted interventions.

Employ these metrics to refine your approach—doubling down on high-impact tactics and phasing out slower methods.

Economic shifts—rising inflation or interest rate changes—can affect your roadmap. Adjust strategies for inflationary economic cycles by refinancing when rates dip and locking in fixed payments to shield your budget from volatility.

Stay informed on central bank policies and market forecasts to time your moves for optimal savings.

No strategy is risk-free. Potential for loss if investments decline requires you to maintain adequate reserves and a diversified portfolio. Avoid overleveraging, which can amplify both gains and losses.

Never lose sight of your core rule: avoid accumulating new debt post consolidation. Treat every loan application as a test of your renewed discipline.

As debts shrink and assets grow, pause to celebrate each milestone. Acknowledge each small victory along the way—whether it’s your first zero-balance account or the initial dollar of passive income.

Keep the momentum alive by continuing your financial education. Maintain momentum with ongoing financial education through books, podcasts, or professional workshops.

Your journey from debt to dollars is a testament to perseverance and planning. By following this roadmap—assessing, strategizing, negotiating, saving, investing, and learning—you’ll transform financial stress into lasting freedom and prosperity.

References