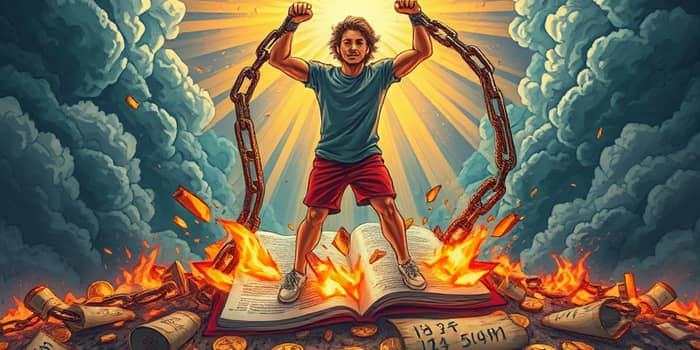

Debt is more than a financial burden—it’s a story we tell ourselves and the structures society uses to hold us down. Defiance begins with rewriting that story and reclaiming control.

Most people think debt is a neutral tool: mortgages build homes, student loans build careers, credit cards build convenience. But debt can also be wielded as a mechanism of power and hierarchy. Anthropologist David Graeber argues debt is an incomplete exchange that hides domination, mixing an illusion of equality with real imbalances.

Recognizing debt as a system of control is the first step toward defiance. When we see how interest, fees, and shame are designed to keep us bound, we can begin to dismantle those invisible chains.

Long before coins and markets, human beings managed obligations through credit and social currencies. Early societies practiced three modes of interaction:

Debt emerged when exchanges were incomplete—but unlike simple hierarchy, it pretended equality while enforcing domination. Ancient Near Eastern civilizations periodically erased debts in grand Jubilees, destroying clay tablets to free people from bondage. These resets show debt is not eternal; communities have reclaimed freedom before—and can again.

Nietzsche’s analysis, via Graeber, unfolds how punishment for debt evolved into permanent guilt. Early justice treated debt like a tab: pay the penalty and both sides were square. Over time, the scope of the creditor expanded to gods and society, making debt infinite and unpayable.

Internalizing this narrative instills permanent moral inferiority. We believe we deserve punishment for owing money. Overcoming this requires separating our self-worth from the balances on a ledger.

Today’s personal debts span a spectrum. Understanding each type, its scale, and its tactics empowers us to fight back.

Predatory practices amplify the burden:

Across jurisdictions, certain rights apply universally. Knowing and exercising them is a powerful form of defiance.

Debt defiance is both an internal shift and an external campaign. Here are practical steps to chart your path:

As you act, dismantle the internal narrative that debt equals failure. Replace it with a story of resilience and shared liberation.

Imagine a society structured on communal care and equitable exchange rather than extractive loans. We can draw inspiration from ancient Jubilees and modern mutual-aid networks to craft financial systems rooted in trust, transparency, and solidarity.

Defiance means demanding new possibilities: public banking, debt jubilees, and policies that treat debtors with dignity. By organizing, advocating, and envisioning alternatives, we pave the way for systemic change.

Debt defiance is a journey from shame to sovereignty. It requires unlearning the myths of moral inferiority, challenging unfair practices, and embracing collective strength. As you navigate repayment, legal challenges, and negotiation, remember that your value transcends any balance.

Break free forever by rewriting the rules, forging supportive communities, and championing policies that uphold human dignity. In solidarity and defiance, a debt-free future is not just possible—it’s inevitable.

References